-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Property tax needs to be repealed / abolished NOW! (Morgan Co info here)

- Thread starter dieselrealtor

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

We went from 1200 to 2800$ in 4 years. Morgan township here. Just south of you!I went from 3800 per year to 5200 because of Washington Township resolution.

Yep, we are way overtaxed. But the constitution did not eliminate taxes, just mostly left it to the states and the people. Nothing the people like better than spending other peoples money…

DragonGunner

Grandmaster

Really? You don't get it at all. So property taxes are the lowest...big freaking deal. Your property worth 5 years ago was worth $600 a year in taxes...but your ok with taxes so we know that. They can't raise taxes....woopy....then the county wants more $$$ for their projects but can't raise taxes that you love, because those really smart politicians were ahead of the game and put a cap on taxes...cause you know, politicians are so smart here. You loved the mask mandates and jabs I'm sure right? So they can't raise taxes to get more $$$.So politicians get someone to pay $185k to jack your tax assessment?

Really? Indiana property taxes are lower than most as mentioned in several posts in this thread. There are plenty of reasons they suck but property taxes are not one IMHO.

Wow!

So they raise property values, because the "smart" politicians never saw that coming. So they say your value is now higher so now your TAX cap is now worthless! Now your paying $3000 in taxes for the same property you own.

So the poor old guy that had a stroke, living on a fixed income because 30 years ago his property tax was $500 and he could always afford that. Is now told his property is now worth several times what he paid for it and has to pay over $3000 a year, and thats $2500 more than he has.

and of course you have to either sell, find a way to pay, or not pay, in which these greta politicians allow the Sheriff to come take your property and sell it....because you know....you NEVER really owned it to begin with. Brilliant.

Sure glad you understand why this is all OK. And you think this make America Great? Brilliant.

you just said the "trash house across the street just sold for $185k". How did the county assessor make someone buy it at that price if the buyer didn't think it was worth it? That's where your logic fails.Really? You don't get it at all. So property taxes are the lowest...big freaking deal. Your property worth 5 years ago was worth $600 a year in taxes...but your ok with taxes so we know that. They can't raise taxes....woopy....then the county wants more $$$ for their projects but can't raise taxes that you love, because those really smart politicians were ahead of the game and put a cap on taxes...cause you know, politicians are so smart here. You loved the mask mandates and jabs I'm sure right? So they can't raise taxes to get more $$$.

So they raise property values, because the "smart" politicians never saw that coming. So they say your value is now higher so now your TAX cap is now worthless! Now your paying $3000 in taxes for the same property you own.

So the poor old guy that had a stroke, living on a fixed income because 30 years ago his property tax was $500 and he could always afford that. Is now told his property is now worth several times what he paid for it and has to pay over $3000 a year, and thats $2500 more than he has.

and of course you have to either sell, find a way to pay, or not pay, in which these greta politicians allow the Sheriff to come take your property and sell it....because you know....you NEVER really owned it to begin with. Brilliant.

Sure glad you understand why this is all OK. And you think this make America Great? Brilliant.

And lets stop the strawman "but you like taxes" bull****. NO ONE here thinks we should be taxed in this manner. NO. ONE. so stop it.

Also the ad hominem attacks in general. Mask mandate? I ****ing left a great job because of it. So you can **** *** *** *** *** if that is what you're going to do.

Last edited:

TL summary: "From each according to ability, to each according to need".Really? You don't get it at all. So property taxes are the lowest...big freaking deal. Your property worth 5 years ago was worth $600 a year in taxes...but your ok with taxes so we know that. They can't raise taxes....woopy....then the county wants more $$$ for their projects but can't raise taxes that you love, because those really smart politicians were ahead of the game and put a cap on taxes...cause you know, politicians are so smart here. You loved the mask mandates and jabs I'm sure right? So they can't raise taxes to get more $$$.

So they raise property values, because the "smart" politicians never saw that coming. So they say your value is now higher so now your TAX cap is now worthless! Now your paying $3000 in taxes for the same property you own.

So the poor old guy that had a stroke, living on a fixed income because 30 years ago his property tax was $500 and he could always afford that. Is now told his property is now worth several times what he paid for it and has to pay over $3000 a year, and thats $2500 more than he has.

and of course you have to either sell, find a way to pay, or not pay, in which these greta politicians allow the Sheriff to come take your property and sell it....because you know....you NEVER really owned it to begin with. Brilliant.

Sure glad you understand why this is all OK. And you think this make America Great? Brilliant.

we were assessed this year at $290k. Since they don't normally assess at what I thought sale price would be I was ready to file an appeal. So I started pricing recently sold houses in our area. Keep in mind, our house is just over 2200sq ft 3bed/2ba on 2 acres with well and septic and a few interior upgrades over time since we've been here 20 years. We built it for $203k.

First house on 1 acre, 2100 sq ft with a smaller garage (2 car, ours is 3+) SOLD for $429k. Second house was 2400sq ft, but 4br/1 bath with detached garage $419k. These are both "rural", with warehouses in their backyard. Our warehouse is at least 1/4 mile away and not directly adjacent. Realtor friends think that if we listed this at $425k we would have a buyer in a week.

So yeah, the assessment sucks because it's higher, but its still less than 70% of what the sale price is. BIL sold his house in Jersey when they moved to Philly for $525k. It was a 3/2 2000sq ft on 1 full acre. His property taxes were $15k per year. Friends of the wife that moved to Indy from The Jersey side of NYC sold their house for $399k. They were paying $11k a year in taxes.

First house on 1 acre, 2100 sq ft with a smaller garage (2 car, ours is 3+) SOLD for $429k. Second house was 2400sq ft, but 4br/1 bath with detached garage $419k. These are both "rural", with warehouses in their backyard. Our warehouse is at least 1/4 mile away and not directly adjacent. Realtor friends think that if we listed this at $425k we would have a buyer in a week.

So yeah, the assessment sucks because it's higher, but its still less than 70% of what the sale price is. BIL sold his house in Jersey when they moved to Philly for $525k. It was a 3/2 2000sq ft on 1 full acre. His property taxes were $15k per year. Friends of the wife that moved to Indy from The Jersey side of NYC sold their house for $399k. They were paying $11k a year in taxes.

While I don't agree that homes should be taxed yearly, we have it a lot better than many many places.

Edit because some people apparently want to make strawmenThey have to have a minimum base to draw from. I have no idea what that is, but I’m sure it is more than we have here. I agree it should be restricted to your local market. Annually I can live here for almost half that it would cost to live in Lafayette. Property assess should reflect that.Are you in either of those counties? I didn’t know they could cross county lines for similar homes…

Hawkeye7br

Expert

I'm sure. I went with my buddy to the assessor's office. They told him they couldn't determine usable/unusable on his pool and to fill it in, and we both understand the logic. What threw us was taxing the sidewalk.Are you sure about that? If used for personal / residential purposes, they should still be part of the homestead exemption. (Though if you're running a business out of them, they can be taxed up to 3%.) See https://www.in.gov/dlgf/files/2023-presentation/231011-Thuma-Presentation-Deductions-Overview.pdf. Also see this court case: SCHIFFLER v. MARION CO. ASSESSOR

Bought this house in 2000, added shed immediately. Tax description provided by realtor was clear, crawl space. Ten years later I did a deep dive into the itemized assessment, discovered I now had a basement! They inspected, admitted error, but had no info on who or when it changed. They saw shed, added $100/year tax on it. At 1%, a $10k valuation on a 12x20 shed on runners? No way correct, but I pay cuz they can jack my house value at will.

On the basement refund, I found the error in March, prior to paying spring taxes. They only allow you to go back 3 years on refund. Instead of refunding previous 3 years payments and correcting future payments, they included the incorrect future payments in the 3 year timeframe, effectively reducing refund to 2 years. I have nothing good to say about these people or their practices.

Stop right now with the personal attacks. If you cannot discuss this rationally then get out of the conversation.Really? You don't get it at all. So property taxes are the lowest...big freaking deal. Your property worth 5 years ago was worth $600 a year in taxes...but your ok with taxes so we know that. They can't raise taxes....woopy....then the county wants more $$$ for their projects but can't raise taxes that you love, because those really smart politicians were ahead of the game and put a cap on taxes...cause you know, politicians are so smart here. You loved the mask mandates and jabs I'm sure right? So they can't raise taxes to get more $$$.

So they raise property values, because the "smart" politicians never saw that coming. So they say your value is now higher so now your TAX cap is now worthless! Now your paying $3000 in taxes for the same property you own.

So the poor old guy that had a stroke, living on a fixed income because 30 years ago his property tax was $500 and he could always afford that. Is now told his property is now worth several times what he paid for it and has to pay over $3000 a year, and thats $2500 more than he has.

and of course you have to either sell, find a way to pay, or not pay, in which these greta politicians allow the Sheriff to come take your property and sell it....because you know....you NEVER really owned it to begin with. Brilliant.

Sure glad you understand why this is all OK. And you think this make America Great? Brilliant.

These bastards taxed my fire-pit! And added improvements due some BS info they pulled from zillow! My house is worth maybe 10k more market then assessed.

Then these pricks wont let you appeal online anymore! You have to print and mail it in! Porter county sucks! I will be moving south here shortly!

Then these pricks wont let you appeal online anymore! You have to print and mail it in! Porter county sucks! I will be moving south here shortly!

"If you drive a car, I'll tax the streetThese bastards taxed my fire-pit! And added improvements due some BS info they pulled from zillow! My house is worth maybe 10k more market then assessed.

Then these pricks wont let you appeal online anymore! You have to print and mail it in! Porter county sucks! I will be moving south here shortly!

If you try to sit, I'll tax your seat

If you get too cold I'll tax the heat

If you take a walk, I'll tax your feet

Taxman!

Cos I'm the taxman, yeah I'm the taxman

Don't ask me what I want it for (Aahh Mr. Wilson)

If you don't want to pay some more (Aahh Mr. Heath)

Cos I'm the taxman, yeah, I'm the taxman

Now my advice for those who die

Declare the pennies on your eyes

Cos I'm the taxman, yeah, I'm the taxman

And you're working for no one but me

Taxman!"

-- George Harrison

Is it a permanent improvement? It is all spelled out in the codes. So if we didn’t tax a 4’ fire pit, at what point do we start? Next thing you know some wealthy owner has a three bedroom, three bath, carriage house he calls a “fire pit”. The fairest way is to tax them all.These bastards taxed my fire-pit!

In Indiana the counties exchange data with the area real estate boards.And added improvements due some BS info they pulled from zillow!

So they could charge you more.My house is worth maybe 10k more market then assessed.

Sounds like Porter county voters need to elect a better assessor.Then these pricks wont let you appeal online anymore! You have to print and mail it in! Porter county sucks!

There are no utopian areas anywhere, some counties are competent others are not.I will be moving south here shortly!

And before I am accused of being a tax lover, there are conversations to be had on our collective dislike of property taxes and a desire to eliminate them and there also is the practical of dealing with our current situation, tax laws, and their implementation. The best way to solve this is to get involved in electing better assessors…

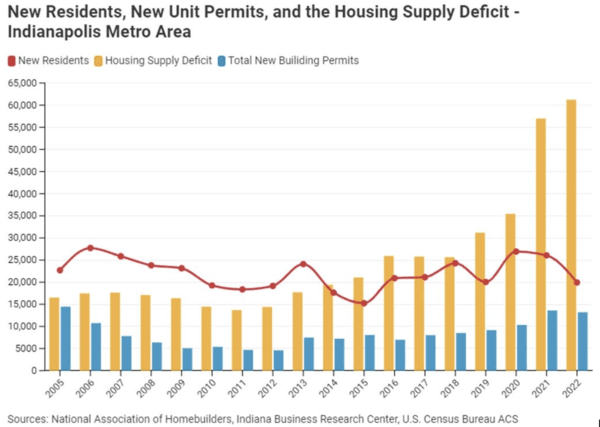

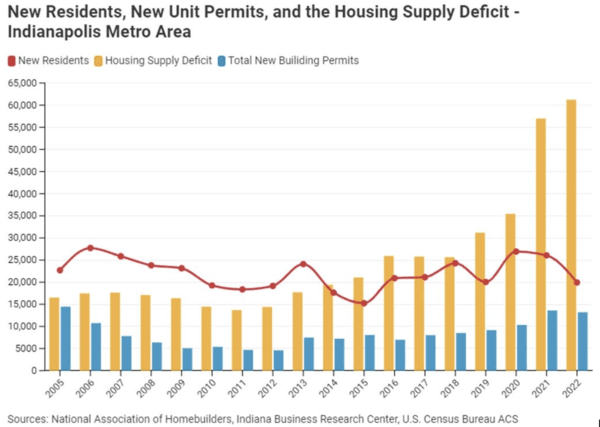

Want to see why your assessed values are rising sharply it can be summed up in a couple of charts.

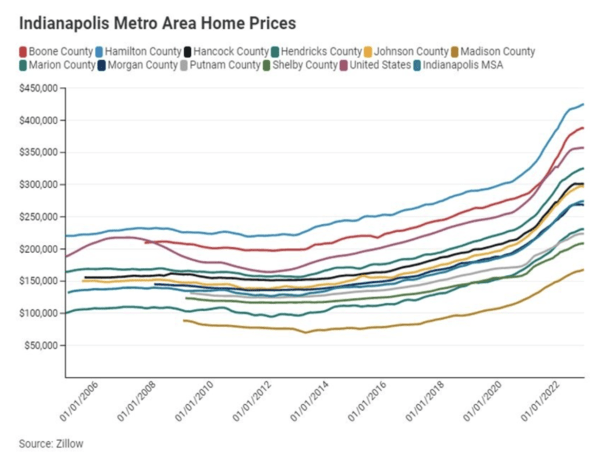

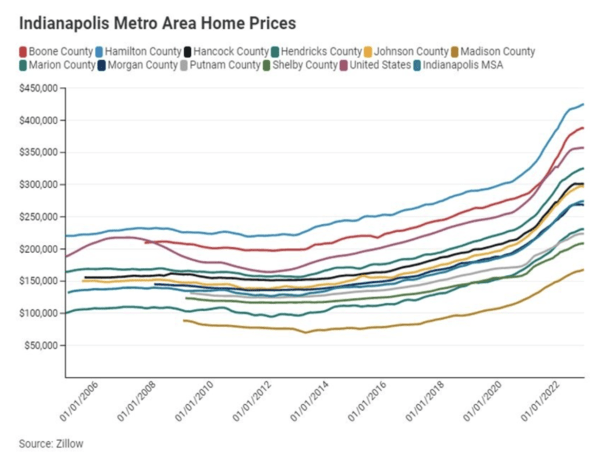

Note the housing supply deficit. That is the demand vs. supply, now let’s look at the results.

Pretty simple really. If one looks at the blue bars in the top chart the area still has not reached the building peak of 2005. My rough count is that since the peak of 2005 there are about 125,000 missing houses in the area. Newer neighborhoods typically turn over at 10% a year meaning there are 12,500 houses a year not available for sale because they were never built…

Note the housing supply deficit. That is the demand vs. supply, now let’s look at the results.

Pretty simple really. If one looks at the blue bars in the top chart the area still has not reached the building peak of 2005. My rough count is that since the peak of 2005 there are about 125,000 missing houses in the area. Newer neighborhoods typically turn over at 10% a year meaning there are 12,500 houses a year not available for sale because they were never built…

soupergenius

Plinker

They demolished a land mark flower shop called Flower's by Dewey. Dewey was a veteran. They forced them to sell so they could make a parking lot for this new Government motricity so the Judges would not need to walk too far to their carsIf you haven't got your bill yet, look it up.

Mine increased by over $5,000 per year! (3 properties)

I have seen people loose their homes due to property taxes in the past, it will be happening again.

EVERYONE NEEDS PRIMARIED AND VOTED OUT!!!!!!!!!!!!!!!!!!

Morgan Co population increased less than 8% in the 20 years from 2002 to 2022, yet VICKIE KIVETT stated in her campaign propaganda mail that they were really focused on the "MUCH NEEDED" Morgan Co Judicial Campus (among other non-truths)

Last time I went through the Annex building, seems that I remember empty space that was not being used.

Names on the sign;

Kenny Hale (I have experienced dishonesty from him personally)

Bryan Collier

Don Adams

Chip Keller

Melissa Greene

Brian Culp

Troy Sprinkle

Kim Merideth

Vickie Kivett

Jason Maxwell

Josh Messmer

Curious how much this abomination is costing the taxpayers:

View attachment 346023

After reading this thread, I understand more why I've noticed so many alternative means of less taxed housing. They include manufactured homes, tiny homes, or barndominiums. I often see refurbished smaller square foot older homes outside the urban/suburban higher taxed areas.

It's a hold out from feudal times where the lord could throw you off "his" land for not paying your tribute (the more things change...). Property taxes are evil, and should be abolished.It has been my personal belief for years that property taxes are immoral.

I've written my various state reps over this on and off over the years.

One wrote me back that he'd be laughed out of the legislature for suggesting it. That was Phil Hinkle, they found another reason.

The rest just ignore the point and send me their form letters with their standard talking points.

Appeal time is generally limited to a certain period after the new assessments come out. As we pay a year in arrears, when the bill hits, it's often too late. Also, appeals may result in an increase.

Last edited:

While, ideally, it would also involve spending cuts — especially in unnecessary boondoggles such as the one with which this thread started — I realize that's about as likely as me flying to the moon because I had chili for dinner.So no one wants to take a swing at the hard questions?

The answer is not easy to make happen, but it is rather simple.

Shift it to other taxes. Everything you mentioned (schools, police & fire protection, county offices, etc.) is of similar benefit to every property and person living in or business domiciled in a political subdivision.

None of it has to be funded by a means that can result in homelessness. That's just the way it has always been.

At one point, having a king was the way it had always been; that didn't make it any more right.

The only fair amount for property taxes is $0.

Last edited:

Yep. Govt needs the shrink. The whole how well we fund schools ,police etc is getting old. We can fund them but don't have to make it to where they get pampered. Schools don't need bright shiny stadiums or theaters. County jails don't need giant law enforcement centers. Hell here in Jefferson co our jail wasnt 17 years old since it was redone.. so what do we do. We build another brand new jail thats also a law enforcement center With a additional payroll tax from county. Now they want their own shooting range cause I guess they don't like using the city's shooting range once a year. Cut the govt. Cut the property tax.While, ideally, it would also involve spending cuts — especially in unnecessary boondoggles such as the one with which this thread started — I realize that's about as likely as me flying to the moon because I had chili for dinner.

The answer is not easy to make happen, but it is rather simple.

Shift it to other taxes. Everything you mentioned (schools, police & fire protection, county offices, etc.) is of similar benefit to every property and person living in or business domiciled in a political subdivision.

None of it has to be funded by a means that can result in homelessness. That's just the way it has always been.

At one point, having a king was the way it had always been; that didn't make it any more right.

The only fair amount for property taxes is $0.

To add insult to injury, I just looked at the duplex next door. It is a mirror image of mine with some minor differences. Overall the differences cancel each other out.My assessment on the land was unchanged, the improvements increased 92%.The total assessment is +/-60% higher than the market value. I filed an appeal in April of 2023. It is still sitting in a pile waiting to be looked at. I live in a duplex. I pulled every sale of duplexes in my township from the market period on which the assessment is based. My assessment per square foot is 72% higher than the highest sale. I plan to got down to the Assessor's office next week and politely destroy them by demonstrating their incompetence.

mine is assessed at $218,000, next door is $135,000. In my appeal I filed in April 2023 I proposed $135,700 for mine.

Staff online

-

d.kaufmanStill Here

Members online

- medavis428@

- flyingsquirrel

- lrdudley

- 88E30M50

- BrentTheBoat

- traderjoe

- Horsetrader

- KARP

- loudgroove

- Old Dog

- chevy2

- Colt556

- partyboy6686

- OutdoorDad

- Michigan Slim

- DoggyDaddy

- Lee11b

- mmpsteve

- INGunHoarder

- migunner

- Hoosierdood

- HKFaninCarmel

- Bowman78

- BeDome

- Zombie

- Joniki

- Fire Lord

- Johnhammel13

- t-squared

- 2A_Tom

- Shadow01

- Gingerbeardman

- fireball168

- d.kaufman

- HoosierHunter07

- darkkevin

- bigz82

- gpasp101

- bobjones223

- slims2002

- Noble Sniper

- latj

- Farmerjon

- ditcherman

- Hkindiana

- Cavman

- Glock Fan

- JTL165

- snorko

- db308

Total: 1,714 (members: 304, guests: 1,410)