Neighborhood too close to **** hole Chicago. Nobody really wants to live there.Oh yeah good point on the illegals but who is to pay for thier housing and needs? Tax payers.

Here in NWI i assure you there is tons of houses sitting empty for different reasons, like being overpriced, developments that were built in hopes of selling amd haven't, area went to crap! Things like that here.

-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Property tax needs to be repealed / abolished NOW! (Morgan Co info here)

- Thread starter dieselrealtor

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

NIMBY syndrome. Take his privilege, not mine. I'm more equal!Yep. Every dollar government spends has a constituency that will scream like lunch whistles if anyone proposes cutting it.

Stick the check with that guy over there! Leave my bike path alone.

Well said! Realized gains is a great point! Just like stocks CEOs get gifted and they dont pay taxes until they sell it.Sauce for the goose, sauce for the gander. Either it's wrong for everyone to rent from the state forever or you're OK with a mechanism that allows government to confiscate your property if you cannot afford to pay the toll. It's theft at the point of a gun. Whether you're Jim Irsay or Joe Blow. Whether you're a legacy owner or the new guy. To let them take money from you every year on zero realized gain is wrong and should provoke every single one of us.

Say the market crashes and your house was "supposedly" 400k for 5 years before the crash, now its 200k! You paid all those years at an inflated price.

Point blank our CONSTITUTIONAL right to life and liberty happiness he and the right to "PERSONAL PROPERTY" has been infringed. I would fight for this but can't do it alone.

Actually the ones closer to chicago all the transplants buy up, hopefully they dont vote the same!Neighborhood too close to **** hole Chicago. Nobody really wants to live there.

Capital gains applies to real estate just as it does stock. This unrealized gains point is not true. Property tax is a tax based on services and benefits property receives for which the basis of the tax is the value of the property. Beyond vague other taxes pronouncements who should pay for services and benefits a property receives?Well said! Realized gains is a great point! Just like stocks CEOs get gifted and they dont pay taxes until they sell it.

You paid your share of services and benefits based on the metric in the law and your new payment will be based on the lower numbers.Say the market crashes and your house was "supposedly" 400k for 5 years before the crash, now its 200k! You paid all those years at an inflated price.

Then you need to recruit candidates that will do this, support them, fund them, vote for them.Point blank our CONSTITUTIONAL right to life and liberty happiness he and the right to "PERSONAL PROPERTY" has been infringed. I would fight for this but can't do it alone.

Like all taxes they each have a slot to fund. In your county if you want that tax to fund police and fire, all you have to do is vote it into being. In other words defund or change the slot where those funds currently go, then put them where you want them to go. But at the county level frankly it’s up to the voters of that county. Now I could be mistaken but I don’t believe a county tax is a state matter. And as I said, I could be wrong. But regardless, how those monies are spent is up to the county PTB.Just a thought, we pay county income tax, why doesn't it pay for police and fire services?

Did he say our "constitutional right to life liberty and happiness"?Capital gains applies to real estate just as it does stock. This unrealized gains point is not true. Property tax is a tax based on services and benefits property receives for which the basis of the tax is the value of the property. Beyond vague other taxes pronouncements who should pay for services and benefits a property receives?

You paid your share of services and benefits based on the metric in the law and your new payment will be based on the lower numbers.

Then you need to recruit candidates that will do this, support them, fund them, vote for them.

Anyhoo, it's a constitutional right to not be deprived of life, liberty or property without due process of law (5th and 14th Amendments). This means with due process of law a person's life liberty or property can be removed from them. Property taxes well predated the Constitution so one has to believe that if taxes on owned land were meant to be unconstitutional, it would have been explicitly stated. By 1868 (14th Amendment), pretty much all the states had property taxes. The issue is political, not constitutional. Elect better people who will cut taxes.

Last edited:

Constitution, Declaration, one of those important documents. It is in-alien-able.Did he say our "constitutional right to life liberty and happiness"?

Anyhoo, it's a constitutional right to not be deprived of life, liberty or property without due process of law (5th and 14th Amendments). This means with due process of law a person's life liberty or property can be removed from them. Property taxes well predated the Constitution so one has to believe that if taxes on owned land were meant to be unconstitutional, it would have been explicitly stated. The issue is political, not constitutional. Elect better people who will cut taxes.

Thats purple folks. ^^^^^^

I think TPTB are using all those documents as TP nowadays...Constitution, Declaration, one of those important documents. It is in-alien-able.

Thats purple folks. ^^^^^^

We usually agree on most things but you drank the coolaid on this one lolCapital gains applies to real estate just as it does stock. This unrealized gains point is not true. Property tax is a tax based on services and benefits property receives for which the basis of the tax is the value of the property. Beyond vague other taxes pronouncements who should pay for services and benefits a property receives?

You paid your share of services and benefits based on the metric in the law and your new payment will be based on the lower numbers.

Then you need to recruit candidates that will do this, support them, fund them, vote for them.

You should pay capital gains real estate investments not your personal property. You can only claim one residence. Like everyone has said here many many times before we are taxed in many angles that would cover services. And the more taxes we pay the service doesn't get BETTER.

That was the declaration of independence lol i had a tad bit of wiskey in my systemDid he say our "constitutional right to life liberty and happiness"?

Anyhoo, it's a constitutional right to not be deprived of life, liberty or property without due process of law (5th and 14th Amendments). This means with due process of law a person's life liberty or property can be removed from them. Property taxes well predated the Constitution so one has to believe that if taxes on owned land were meant to be unconstitutional, it would have been explicitly stated. By 1868 (14th Amendment), pretty much all the states had property taxes. The issue is political, not constitutional. Elect better people who will cut taxes.

Please explain the (Denny alert) Kool Aid I drank? Is there something factually wrong? I think you may need to study up on tax law, not that I am an expert, but I understand the basics. You are welcome to say what you think but the law may be different and I am discussing reality not pipe dreams.We usually agree on most things but you drank the coolaid on this one lol

You should pay capital gains real estate investments not your personal property. You can only claim one residence. Like everyone has said here many many times before we are taxed in many angles that would cover services. And the more taxes we pay the service doesn't get BETTER.

If you buy a truck for $20,000 and sell it for $27,000 you actually owe capital gains taxes, though I doubt most folks pay that. The same applies to any personal property including real estate and that includes your home. There currently is an exemption for $250,000/$500,000 of lifetime gain for personal homes.

I said:

“Capital gains applies to real estate just as it does stock. This unrealized gains point is not true. Property tax is a tax based on services and benefits property receives for which the basis of the tax is the value of the property. Beyond vague other taxes pronouncements who should pay for services and benefits a property receives?”

What is incorrect in that? People here are throwing around terms they do not know the meaning of. If they want to say it is analogous to unrealized gains, all good, but property tax owed is based on the current value, that is not a tax on unrealized gain.

It is hard to discuss property tax if people do not even have the slightest concept of what is paid from property taxes. There are a lot of specifics that directly relate to the property that are paid for by property taxes, and then there are the things like good schools increase property values, so to perpetuate that property owners pay for schools. All that can be discussed but if folks don’t know that the gas tax does not pay for all roads and all maintenance and property taxes it is difficult to even have a disorder who should pay for those benefits and how.

Point blank our CONSTITUTIONAL right to life and liberty happiness he and the right to "PERSONAL PROPERTY" has been infringed. I would fight for this but can't do it alone.

I replied:

“Then you need to recruit candidates that will do this, support them, fund them, vote for them.”

The framers could have eliminated property tax, but didn’t. This has nothing to do with the constitution at all. This is states and local, remember “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people”?

The framers were genus, but our forefathers of more recent vintage had reasons they set things up the way they did, that includes the property tax. So we almost all agree philosophically that the property tax eliminates clear ownership, I suspect we also agree that those that receive benefits should pay for them.

So who should pay for government benefits to property? How should they pay it?

Heard from the County. They reduced the assessment by $73,000 to $145,000. They pointed out some of the data I used was out of the date range (my bad) and after reflection I accepted the new assessment which apparently will be carried forward to 2024 pay 2025 as well.To add insult to injury, I just looked at the duplex next door. It is a mirror image of mine with some minor differences. Overall the differences cancel each other out.

mine is assessed at $218,000, next door is $135,000. In my appeal I filed in April 2023 I proposed $135,700 for mine.

What are these mythical services provided to my property annually?

I maintain my property with zero help from the govt.

Utilities? nope

Well and septic? mine

Lawn care? Drive grading? Snow removal 1/2 miles to the county road? Nope

Appliance repair and replacement?

Pond upkeep? Firewood?

I get the argument about roads, schools, fire and police. I disagree, but I understand it. Help me with the annual support my home and land receive as a result of my not so insignificant contribution.

I maintain my property with zero help from the govt.

Utilities? nope

Well and septic? mine

Lawn care? Drive grading? Snow removal 1/2 miles to the county road? Nope

Appliance repair and replacement?

Pond upkeep? Firewood?

I get the argument about roads, schools, fire and police. I disagree, but I understand it. Help me with the annual support my home and land receive as a result of my not so insignificant contribution.

Wow you always write books. You don't have to beat it to death to get the point across lol the cool aid is you aound like advocate for over taxation.Please explain the (Denny alert) Kool Aid I drank? Is there something factually wrong? I think you may need to study up on tax law, not that I am an expert, but I understand the basics. You are welcome to say what you think but the law may be different and I am discussing reality not pipe dreams.

If you buy a truck for $20,000 and sell it for $27,000 you actually owe capital gains taxes, though I doubt most folks pay that. The same applies to any personal property including real estate and that includes your home. There currently is an exemption for $250,000/$500,000 of lifetime gain for personal homes.

I said:

“Capital gains applies to real estate just as it does stock. This unrealized gains point is not true. Property tax is a tax based on services and benefits property receives for which the basis of the tax is the value of the property. Beyond vague other taxes pronouncements who should pay for services and benefits a property receives?”

What is incorrect in that? People here are throwing around terms they do not know the meaning of. If they want to say it is analogous to unrealized gains, all good, but property tax owed is based on the current value, that is not a tax on unrealized gain.

It is hard to discuss property tax if people do not even have the slightest concept of what is paid from property taxes. There are a lot of specifics that directly relate to the property that are paid for by property taxes, and then there are the things like good schools increase property values, so to perpetuate that property owners pay for schools. All that can be discussed but if folks don’t know that the gas tax does not pay for all roads and all maintenance and property taxes it is difficult to even have a disorder who should pay for those benefits and how.

I replied:

“Then you need to recruit candidates that will do this, support them, fund them, vote for them.”

The framers could have eliminated property tax, but didn’t. This has nothing to do with the constitution at all. This is states and local, remember “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people”?

The framers were genus, but our forefathers of more recent vintage had reasons they set things up the way they did, that includes the property tax. So we almost all agree philosophically that the property tax eliminates clear ownership, I suspect we also agree that those that receive benefits should pay for them.

So who should pay for government benefits to property? How should they pay it?

Just because it is a law doesn't make it constitutionally correct or ethical. THATS THE REALITY.

Nothing we do will change unless the WHOLE system is removed amd replaced. THAT IS THE PIPE DREAM at least till Jesus returns lol

Exactly!!!! I live in the county and the nearest fire hydrant is a 1/4 mile away! Our fire dept is VOLUNTARY no wages. Our houses will burn to the gound. Our storm drains empty into a ravine that runs dry! We all have well and septic. I work for nipsco so we maintain that but the rate payers pay for that service.What are these mythical services provided to my property annually?

I maintain my property with zero help from the govt.

Utilities? nope

Well and septic? mine

Lawn care? Drive grading? Snow removal 1/2 miles to the county road? Nope

Appliance repair and replacement?

Pond upkeep? Firewood?

I get the argument about roads, schools, fire and police. I disagree, but I understand it. Help me with the annual support my home and land receive as a result of my not so insignificant contribution.

Our roads are completely crumbling! The school is tiny and been rebuilt but they continued the expired referendum!

All we get is the damn accessor and code enforcement trying to harrass us into more fines ams taxes. Police are decent thankfully but they are funded mainly from the state and state taxes.

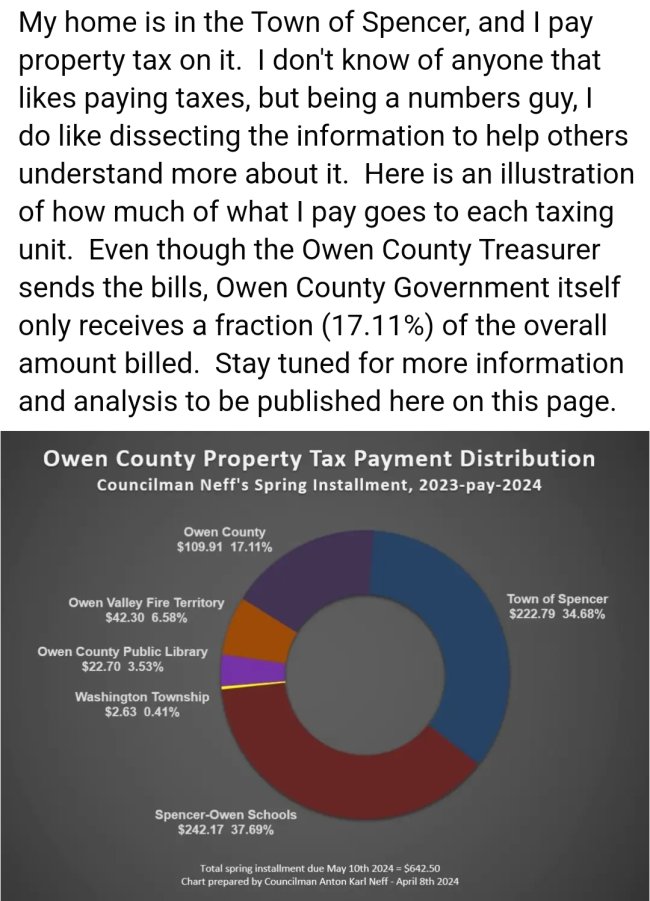

You should learn what your taxes cover, and the pie chart posted here doesn't get into enough detail. The country offices that maintain deeds, the surveyors office, the drainage offices are just a couple that directly benefit your property. Funny how the lack of knowledge on a topic makes it mythical…What are these mythical services provided to my property annually?

I maintain my property with zero help from the govt.

Utilities? nope

Well and septic? mine

Lawn care? Drive grading? Snow removal 1/2 miles to the county road? Nope

Appliance repair and replacement?

Pond upkeep? Firewood?

I get the argument about roads, schools, fire and police. I disagree, but I understand it. Help me with the annual support my home and land receive as a result of my not so insignificant contribution.

Maybe read my posts then, I told you explicitly I do not like taxes. Did you not read that? If you don’t know what property tax pay for and have no solution to offer as to who and how those services and benefits should be paid then people are just complaining.Wow you always write books. You don't have to beat it to death to get the point across lol the cool aid is you aound like advocate for over taxation.

Please show how property tax is unconstitutional. The reality is it is the norm and those of us that believe it encumbers property ownership are in a significant minority of people.Just because it is a law doesn't make it constitutionally correct or ethical. THATS THE REALITY.

You do realize that the US is still the outlier for freedom of the major countries?Nothing we do will change unless the WHOLE system is removed amd replaced. THAT IS THE PIPE DREAM at least till Jesus returns lol

Now who should pay for services and benefits to property if it is not property owners?

Members online

- dieselrealtor

- Magyars

- Browning2022

- COOPADUP

- Born2vette

- Mgderf

- medavis428@

- Hawkeye7br

- KJQ6945

- Judamonster

- patience0830

- mmpsteve

- buddyshoosierpal

- El Conquistador

- flyingsquirrel

- Lee11b

- Dante1983

- baldmax

- way2good4u95

- jagee

- Reale1741

- Lassiter

- Squid556

- Hawkeye

- slims2002

- Goodcat

- phylodog

- fender

- RJW

- BigBoxaJunk

- 04FXSTS

- pitbulld45

- spencer rifle

- Damdamdon

- 45/70 Henry Lover

- 76caprice

- clelaj

- nrar15

- williamsburg

- joe138

- Mr.Softball

- OneBadV8

- 2A Defender

- indyjohn

- sumphead

- Wabatuckian

- BD63

- DoggyDaddy

- DeadeyeChrista'sdad

- Count Blackula

Total: 1,891 (members: 174, guests: 1,717)