Situation: My dad bought his 2021 Ram after the lease ended then he leased a new 2024 Ram. I am in the process of buying the 2021 Ram from him. He paid ~$2500 in state sale tax 3 weeks ago. He has rolled all the tax and fees into the price of the truck.

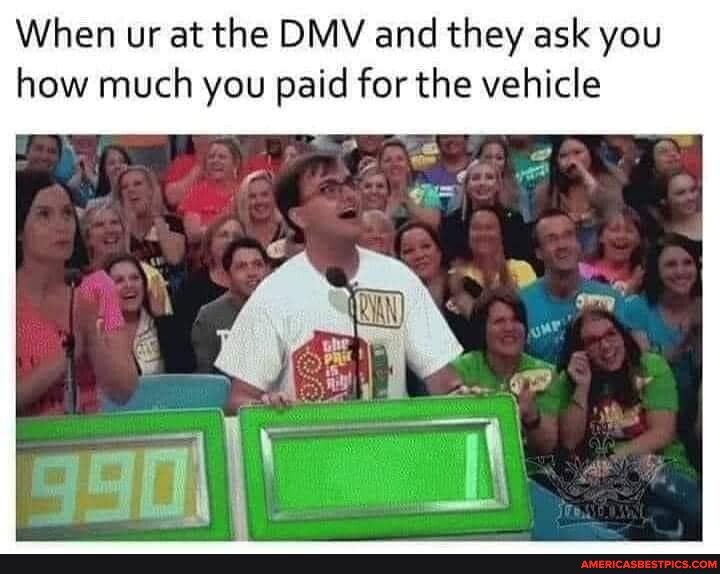

Do I now have to pay state sale tax again when I register it in my name? If so, are there any exemptions that may fit this situation?

I have read that a gift doesn't get taxed because there isn't a selling price to assess the tax from. The problem I see with saying it's a gift is that I borrowed money and the title will need a lien.

Thoughts?

Do I now have to pay state sale tax again when I register it in my name? If so, are there any exemptions that may fit this situation?

I have read that a gift doesn't get taxed because there isn't a selling price to assess the tax from. The problem I see with saying it's a gift is that I borrowed money and the title will need a lien.

Thoughts?