-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is Silver next?

- Thread starter Magyars

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

That seems to be the industrial standards for most appliance wirering for the past 20yrs I'd say. Lots of "wtf" when i had been scrapping wire from transformers and tvs. Microwave transformers are very steel heavy. Cut the wire off and it's light as a feather. Aluminum wire colored like copper. Makes me wonder if the scrapyards pay motor/transformer prices unless they know to scrap the wire to check for 100% copper under the varnish.But beware of copper clad aluminum (or steel). Hold out for the real-deal.

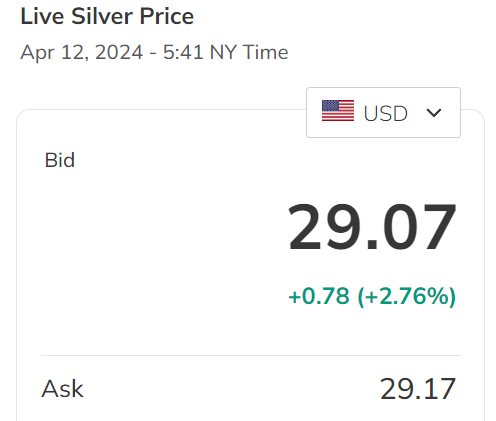

Well I decided to unload some silver during this little spike. Went to my lcs and sold a bunch of generic rounds (they paid me $27 per ounce) which is more than I paid for them and I took the cash and bought my fiancés wedding band with it.

Fair price in my mind and I made a necessary purchase with the cash so I’m happy. I prefer stacking junk silver and ase’s so I was fine letting a chunk of the generic stuff go.

Fair price in my mind and I made a necessary purchase with the cash so I’m happy. I prefer stacking junk silver and ase’s so I was fine letting a chunk of the generic stuff go.

So, trade some metal for some other metal + lady. If I got that right sounds like you got a great deal. Congratulations.Well I decided to unload some silver during this little spike. Went to my lcs and sold a bunch of generic rounds (they paid me $27 per ounce) which is more than I paid for them and I took the cash and bought my fiancés wedding band with it.

Fair price in my mind and I made a necessary purchase with the cash so I’m happy. I prefer stacking junk silver and ase’s so I was fine letting a chunk of the generic stuff go.

I wouldn't have had to sell much silver to buy my wedding bands (both).Well I decided to unload some silver during this little spike. Went to my lcs and sold a bunch of generic rounds (they paid me $27 per ounce) which is more than I paid for them and I took the cash and bought my fiancés wedding band with it.

I paid $35 for our white gold bands, from a failed marriage. Some people think that puts some bad juju on a marriage.

We'll be married 43 years at the end of this month. If our marriage goes south I'll let you guys know.

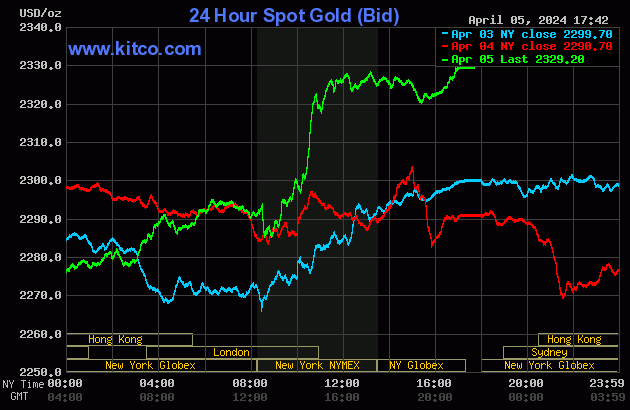

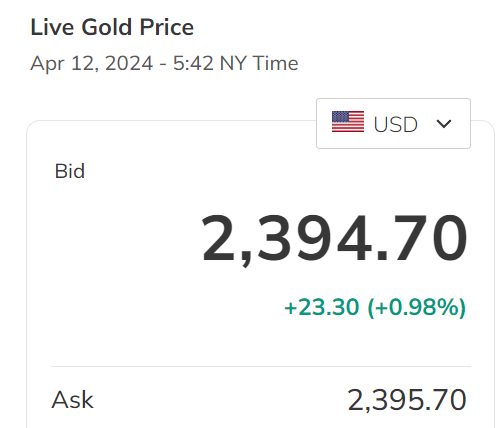

Weekends are known for metal being safe harbors to avoid any pitfalls that may occur while our markets are closed. A lot can happen between close Fri. and open Mon. Same for long holidays. JMOWell the Dow is up, 10 year Treasuries are up, and PMs are rocking. Kinda weird but I'll take it.

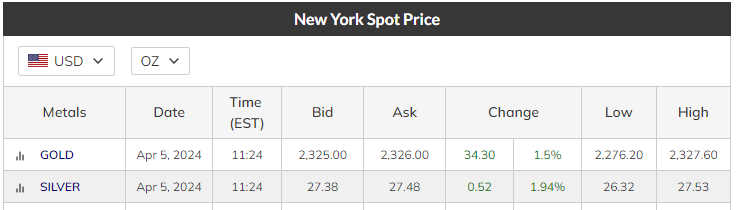

View attachment 344830

OutdoorDad

Master

I own silver. And gold. But I don't trade them and they aren't part of my portfolio.Wait!

You’re a silver bug and I mistook your meaning. .???? Seriously.

Neither is a good hedge against inflation. The inverse correlation isn't there.

They ARE a good store of value. So I accumulate them. Knowing that the Hunt brothers are both dead and that's not happening again.

And the gold run in the 80's is also unlikely.

So, no. Silver isn't "next"

That was my point.

Agree 100%, have said these very things in this thread many times.I own silver. And gold. But I don't trade them and they aren't part of my portfolio.

Neither is a good hedge against inflation. The inverse correlation isn't there.

They ARE a good store of value. So I accumulate them. Knowing that the Hunt brothers are both dead and that's not happening again.

And the gold run in the 80's is also unlikely.

So, no. Silver isn't "next"

That was my point.

A lot of folks don’t even know who/about the hunt’s and their failed attempt.

OutdoorDad

Master

had a dormmate in college who's grandmother was funding his education.Agree 100%, have said these very things in this thread many times.

A lot of folks don’t even know who/about the hunt’s and their failed attempt.

she moved his entire college fund into gold in 1980ish. Like gave him the Krugerrands. The actual coins. And wished him luck.

He was a dick.

Frankly, no one in the dorm cried for him.

He learned "diversification" like no one I've ever seen before or since.

Que Sera, Serahad a dormmate in college who's grandmother was funding his education.

she moved his entire college fund into gold in 1980ish. Like gave him the Krugerrands. The actual coins. And wished him luck.

He was a dick.

Frankly, no one in the dorm cried for him.

He learned "diversification" like no one I've ever seen before or since.

dieselrealtor

Master

Thank you! Definitely a fair trade!So, trade some metal for some other metal + lady. If I got that right sounds like you got a great deal. Congratulations.

Sounds like a smart way to go. We used Shane co. With the engagement right and band I’m 9k in now haha. But I’m only doing this once and wanted to do something special for her- mission accomplished so I’m happy!I wouldn't have had to sell much silver to buy my wedding bands (both).

I paid $35 for our white gold bands, from a failed marriage. Some people think that puts some bad juju on a marriage.

We'll be married 43 years at the end of this month. If our marriage goes south I'll let you guys know.

dieselrealtor

Master

Do the math for 3000.00 gold at ~80:1, (for AG prices) I can possibly that is ”possibly“ mind you, see that as an end point, (by years end) The local silver bugs are already jumping ship. Some don’t understand what metals are. The mental pressure at 3000.00 will be more than most can stand. JMO, not financial advice just my thoughts. Things should/will get more interesting around election time. Especially if the FED changes their mind on interest rates.

snapping turtle

Grandmaster

My silver just sets. I think I am dollar cost averaged around 18.55 an ounce and at covid it was under 18.20.

if I can not pay Caesar what is Caesars then I have the silver.

I love the fact it is going up in price again. I got Started in silver when I saw a few gun show guys who said price for cash or silver at spot.. well the wife won’t mind if I buy silver and it is easy to change thing into and out of guns. A couple rolls of silver go and a new gun takes its place.

I think I traded silver for an sig p220. The rest has just sat on the second shelf of the safe and now the big bars are on the floor of the safe.

if I can not pay Caesar what is Caesars then I have the silver.

I love the fact it is going up in price again. I got Started in silver when I saw a few gun show guys who said price for cash or silver at spot.. well the wife won’t mind if I buy silver and it is easy to change thing into and out of guns. A couple rolls of silver go and a new gun takes its place.

I think I traded silver for an sig p220. The rest has just sat on the second shelf of the safe and now the big bars are on the floor of the safe.

I have some silver. I like the idea that it is going up. I hate the reality that it is not going up, but all my hard earnings that are in dollars are losing buying power every day.

It is sad to look at a statement of how much I "made" on 4.85% return CD's and realize that I really lost about 8% of buying power, not to mention I still owe taxes on the "increase".

It is sad to look at a statement of how much I "made" on 4.85% return CD's and realize that I really lost about 8% of buying power, not to mention I still owe taxes on the "increase".

Staff online

-

GodFearinGunTotinSuper Moderator

Members online

- Ingomike

- rbhargan

- Reale1741

- CheeseRat

- Mr. Habib

- KLB

- DoggyDaddy

- spencer rifle

- XDdreams

- ws6guy

- rhamersley

- OneBadV8

- nettinyahoo

- bobzilla

- pokersamurai

- el_barto3

- HoughMade

- ZurokSlayer7X9

- snapping turtle

- Chip

- kyledmiller36

- NHT3

- tjones

- Hopper

- Alamo

- maxipum

- Talkinghalls

- jsharmon7

- Wolfhound

- Dog1

- indyblue

- Born2vette

- Airtevron1

- cosermann

- STAGE 2

- WebSnyper

- cedartop

- deo62

- BugI02

- indiucky

- Ford Truck

- GodFearinGunTotin

- Hoosierdood

- Mpow18

- BP84

- Gandalf

- Tripp11

- GunsCarsPlanes

- ghuns

- tribeofham

Total: 1,784 (members: 214, guests: 1,570)