Yep. They took a personal check on both.Really? I've never had any problem. Dealers have always accepted a personal check. (I think once I had to provide a cashier's check for a car I was buying out-of-state.) I wonder if they "said" it was easier just to get you to finance. They were hoping you wouldn't pay it off immediately.

-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retirement Thoughts

- Thread starter firecadet613

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

Plenty of dealers don't like cash deals anymore. Times have changed. Cash is no longer king. It is also unlikely to get you a better deal.Really? I've never had any problem. Dealers have always accepted a personal check. (I think once I had to provide a cashier's check for a car I was buying out-of-state.) I wonder if they "said" it was easier just to get you to finance. They were hoping you wouldn't pay it off immediately.

says you. My experience was different than that.Plenty of dealers don't like cash deals anymore. Times have changed. Cash is no longer king. It is also unlikely to get you a better deal.

Well, I'm going to be the one that will admit, I did a lot of things wrong in my early years. I lived beyond my means in order to be a decent neighborhood and school district when we were raising the kids. I didn't aggressively save/invest during most of my working years. I spent my HSA money throughout the year on unreimbursed medical expenses. I had no idea that one should leave it sit and grow.

I bought and sold a few stocks over the years, but never really caught on how to make consistent money doing that. I guess I was too focused on the day to day.

That said, I did contribute to 401K's for most of my career, at times over the maximum amount(last few paychecks of some years, no deductions for the 401K).

I never gave any thought about ever retiring until Covid at which point I was turning 61. Since then I have have been working diligently to prepare for retirement. I was sure that there was no way I could ever retire. This was based on what I hear here on INGO what folks have and on internet videos on finance. The world has changed post covid and I no longer enjoy my chosen profession. It's time to call it a day.

I finally met with a financial advisor and she looked at my portfolio and assured me that I am okay. Some of the best advice I got from her was; "quit watching those videos!" I don't have a $1mil in my accounts and never will. But I don't need $100,000/year to live on in retirement. I won't have any debt, my wife and I lead a simple life and I have lived on a modest income all of my life. Waiting until 70 to claim SS will provide the income needed to live our lives out in the style we desire.

I am retiring at the end of this year when I turn 65. I will get on Medicare, take some part time work and draw from my portfolio for 5 years until SS kick in.

My advice to you though is don't do what I did and I can see you already aren't since you are seeking knowledge now in your 40's. Good on you!

I bought and sold a few stocks over the years, but never really caught on how to make consistent money doing that. I guess I was too focused on the day to day.

That said, I did contribute to 401K's for most of my career, at times over the maximum amount(last few paychecks of some years, no deductions for the 401K).

I never gave any thought about ever retiring until Covid at which point I was turning 61. Since then I have have been working diligently to prepare for retirement. I was sure that there was no way I could ever retire. This was based on what I hear here on INGO what folks have and on internet videos on finance. The world has changed post covid and I no longer enjoy my chosen profession. It's time to call it a day.

I finally met with a financial advisor and she looked at my portfolio and assured me that I am okay. Some of the best advice I got from her was; "quit watching those videos!" I don't have a $1mil in my accounts and never will. But I don't need $100,000/year to live on in retirement. I won't have any debt, my wife and I lead a simple life and I have lived on a modest income all of my life. Waiting until 70 to claim SS will provide the income needed to live our lives out in the style we desire.

I am retiring at the end of this year when I turn 65. I will get on Medicare, take some part time work and draw from my portfolio for 5 years until SS kick in.

My advice to you though is don't do what I did and I can see you already aren't since you are seeking knowledge now in your 40's. Good on you!

I agree that they don't "like" it. Most dealers make more off of financing than off of new car sales. But I've never heard of one who won't accept it if you press them. I always make the deal first, get everything in writing while deferring "how will you pay for this." After all is agreed, then I break out my checkbook to their chagrin.Plenty of dealers don't like cash deals anymore. Times have changed. Cash is no longer king. It is also unlikely to get you a better deal.

WanderingSol07

Sharpshooter

Yes, Total Wealth Planning on the north side of Indy on Pennsylvania Avenue. I have been dealing with them for about ten years and my wife and I retired two years ago.So anyone have a financial advisor that they trust that is an advisory fee based only (by the hour, etc and not based on amount of portfolio $ you have and that is not selling investments)? Just curious.

Thanks, I'll look them up.Yes, Total Wealth Planning on the north side of Indy on Pennsylvania Avenue. I have been dealing with them for about ten years and my wife and I retired two years ago.

spencer rifle

Grandmaster

We are on a 2 year countdown to retirement, and it looks like we will make more in retirement than working. This has been a long road and will take some time to retrace. We got here by being very aware of spending. Fortunately we have inexpensive tastes (though my X95 addiction is expensive). Now if we can just avoid a currency collapse...

I have always worked for local government - pay is bad but pension is OK. We were Crown Ministries instructors in the past, so we know how to keep a budget, which doesn't give you more money, but at least you know where it went. We made some commitments early in our relationship: all money is "our" money - we are a team. We put away money for our kids futures, even if it's just pocket change. We will avoid debt in all cases. Two past exceptions - the house and a few vehicles, though we have owned all of those outright for years. If we can't afford something now, we will wait to get it until we can. Always pay the credit card off every month (we only have one and had it since 1992). Get term life insurance. Keep an emergency fund equal to several months income - it's amazing how many people can't deal with a $500 emergency without going into debt. Always tithe, even if you don't think you have enough. Dollar cost averaging is your friend, along with compound interest. Discipline is required.

None of my employers have ever had any self-directed or matching plans like a 401K, so we set up our own IRAs long ago. I did a LOT of research back when we were choosing investments (looking through books - online didn't exist yet). The main objectives were good return and low expenses. You can't control the market, or the behavior of managers, but you can control expenses. SWMBO has a LOT less tolerance for risk than I do, so compromises were necessary.

Diversification is important - we have regular and Roth IRAs, carefully chosen annuities (a relatively recent diversification, with retirement looming and all), PMs, three Bs, cash, a rental property. We put an extra $100 into our mortgage every month and turned a 30 year mortgage into a 17 year.

A recent possible mistake - I was transferring $ from an IRA to a Roth, and was planning on moving a thousand periodically to stay below our tax threshold. I thought I was transferring dollars, but it turns out our company only transfers shares and not dollars. So I thought I was moving $1000 but actually moved 1000 shares - over $130,000.00. Our tax guy was not happy, but realized this could be a good thing in the long run - taxes will only ever go up in the future. But we would have to make quarterly tax payments, and they would not be small. Through our emergency fund (since restocked) and extra cash we held, we made all the payments on time and in full.

All our kids grew up in those conditions, and we educated them thusly. As adults they have thanked us, since they see their peers all around them floundering financially while they already had IRAs in their 20s and own property outright.

I have always worked for local government - pay is bad but pension is OK. We were Crown Ministries instructors in the past, so we know how to keep a budget, which doesn't give you more money, but at least you know where it went. We made some commitments early in our relationship: all money is "our" money - we are a team. We put away money for our kids futures, even if it's just pocket change. We will avoid debt in all cases. Two past exceptions - the house and a few vehicles, though we have owned all of those outright for years. If we can't afford something now, we will wait to get it until we can. Always pay the credit card off every month (we only have one and had it since 1992). Get term life insurance. Keep an emergency fund equal to several months income - it's amazing how many people can't deal with a $500 emergency without going into debt. Always tithe, even if you don't think you have enough. Dollar cost averaging is your friend, along with compound interest. Discipline is required.

None of my employers have ever had any self-directed or matching plans like a 401K, so we set up our own IRAs long ago. I did a LOT of research back when we were choosing investments (looking through books - online didn't exist yet). The main objectives were good return and low expenses. You can't control the market, or the behavior of managers, but you can control expenses. SWMBO has a LOT less tolerance for risk than I do, so compromises were necessary.

Diversification is important - we have regular and Roth IRAs, carefully chosen annuities (a relatively recent diversification, with retirement looming and all), PMs, three Bs, cash, a rental property. We put an extra $100 into our mortgage every month and turned a 30 year mortgage into a 17 year.

A recent possible mistake - I was transferring $ from an IRA to a Roth, and was planning on moving a thousand periodically to stay below our tax threshold. I thought I was transferring dollars, but it turns out our company only transfers shares and not dollars. So I thought I was moving $1000 but actually moved 1000 shares - over $130,000.00. Our tax guy was not happy, but realized this could be a good thing in the long run - taxes will only ever go up in the future. But we would have to make quarterly tax payments, and they would not be small. Through our emergency fund (since restocked) and extra cash we held, we made all the payments on time and in full.

All our kids grew up in those conditions, and we educated them thusly. As adults they have thanked us, since they see their peers all around them floundering financially while they already had IRAs in their 20s and own property outright.

Last edited:

I bought out of state and it was a quick deal, they didn't accept out of state checks. Got a hell of a deal on NYE, they wanted a wire or finance it.Really? I've never had any problem. Dealers have always accepted a personal check. (I think once I had to provide a cashier's check for a car I was buying out-of-state.) I wonder if they "said" it was easier just to get you to finance. They were hoping you wouldn't pay it off immediately.

I got their after banking hours and did the financing. Cost me maybe $50 in interest, paid it off as soon at it was in their system...

Trust me, I know how to buy cars...

No mention was made of the order of importance. I'll take the mention of God at all as a positive these days.Reverse the order….

Avoiding debt lets you use your most powerful wealth building tool, your income, to benefit yourself instead of the bank. Don't invest in anything you don't understand. Proper insurance to protect yourself is a plus but insurance companies are a poor place for retirement savings. Term life until you can self insure if someone else depends on your income is wise. Pay yourself first by saving was my Grandparent's advice and they managed to bequeath a serious legacy to children and grandkids.

I'll echo this and add, if the deal isn't done and in writing before you arrive, you're wasting time...I agree that they don't "like" it. Most dealers make more off of financing than off of new car sales. But I've never heard of one who won't accept it if you press them. I always make the deal first, get everything in writing while deferring "how will you pay for this." After all is agreed, then I break out my checkbook to their chagrin.

I negotiate with many dealers at once via text, may the best one win!

Yes those videos are meant to scare youWell, I'm going to be the one that will admit, I did a lot of things wrong in my early years. I lived beyond my means in order to be a decent neighborhood and school district when we were raising the kids. I didn't aggressively save/invest during most of my working years. I spent my HSA money throughout the year on unreimbursed medical expenses. I had no idea that one should leave it sit and grow.

I bought and sold a few stocks over the years, but never really caught on how to make consistent money doing that. I guess I was too focused on the day to day.

That said, I did contribute to 401K's for most of my career, at times over the maximum amount(last few paychecks of some years, no deductions for the 401K).

I never gave any thought about ever retiring until Covid at which point I was turning 61. Since then I have have been working diligently to prepare for retirement. I was sure that there was no way I could ever retire. This was based on what I hear here on INGO what folks have and on internet videos on finance. The world has changed post covid and I no longer enjoy my chosen profession. It's time to call it a day.

I finally met with a financial advisor and she looked at my portfolio and assured me that I am okay. Some of the best advice I got from her was; "quit watching those videos!" I don't have a $1mil in my accounts and never will. But I don't need $100,000/year to live on in retirement. I won't have any debt, my wife and I lead a simple life and I have lived on a modest income all of my life. Waiting until 70 to claim SS will provide the income needed to live our lives out in the style we desire.

I am retiring at the end of this year when I turn 65. I will get on Medicare, take some part time work and draw from my portfolio for 5 years until SS kick in.

My advice to you though is don't do what I did and I can see you already aren't since you are seeking knowledge now in your 40's. Good on you!

I have said it before here so I am on record. Now my numbers may be out of date but whatever the 12% tax bracket is is where I want my annual income-charitable giving. Thats close to $90K, I think. Social Security should give me ~$36K annually of that roughly so I need ~$54K annually from my savings. Our savings for retirement right now is coming in at about $40K annually.

Biggest unknown is my wife has major medical expenses due to a auto immune disease that I can't predict very well. Fine while I have HSA. She maxes out her deductible by March on medications alone.

I wanted to go at 59 1/2 but will not be able to because of that. At first I was like I would have to work until I am 69 just to get her to medicare, but a friend of mine said put her on Obamacare. If that is viable, I will. So I may change and plan to 65 but hope for 62 if that works out.

5 year plan going into retirement is 5 major expenses while working. That way if any of those hiccup, I can just work another year

If the world goes down the toilet, then these can all be cut or curtailed.

If the world goes down the toilet, then these can all be cut or curtailed.1. New car

2. New Truck

3. New Fifth Wheel

4. Complete House Remodel

5. New Shop and New Tractor

Assets? Portfolio's? Dividends?

What are these things you speek of?

Remind me again how stupid I have been with money...lol.

I have my little 401k. I put as much as I can in it but my retirement will be meager. I wish I knew then what I know now.

What are these things you speek of?

Remind me again how stupid I have been with money...lol.

I have my little 401k. I put as much as I can in it but my retirement will be meager. I wish I knew then what I know now.

My less than 1 year looks like this:

1. Sell current home, purchase final home with cash

2. Pay off my car. I have the money in a money market earning 5.2% and my loan is 0.9, so I may not pay it off

3. Make a decision on my wife's car. She would like to keep it a few more years. We will see.

4. Related to number 1, get house ready for sale.

My wife is planning on working 2 more years after I retire, mostly to have insurance, but if she is ready, we will look into Obamacare to fund the gap until she turns 65.

1. Sell current home, purchase final home with cash

2. Pay off my car. I have the money in a money market earning 5.2% and my loan is 0.9, so I may not pay it off

3. Make a decision on my wife's car. She would like to keep it a few more years. We will see.

4. Related to number 1, get house ready for sale.

My wife is planning on working 2 more years after I retire, mostly to have insurance, but if she is ready, we will look into Obamacare to fund the gap until she turns 65.

Amen to that brother! I am just very happy that both of my kids are socking away large sums of money. My son is in the Space Force and not only will he have his retirement, but he is putting extra away.I wish I knew then what I know now.

My daughter, who makes a LOT of money lives very frugally and both her and her husband have been investing money since before they were married.

That's the main downside for me. I will retire pretty soon (long before 65) and Obamacare exchange insurance is the only reason I haven't already. Very few options, very expensive and only mediocre insurance coverage....we will look into Obamacare to fund the gap...

spencer rifle

Grandmaster

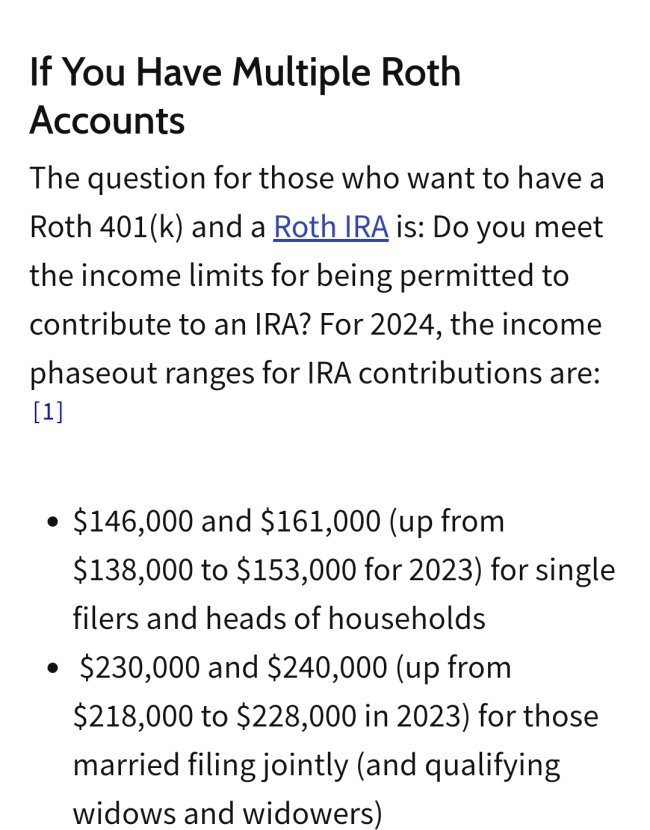

I never had to worry about that, so I didn't pay attention. Never will get anywhere near those limits.There's no such thing as a stupid question.

If I'm reading this right, if you make over these amounts you're stuck with just your employer Roth 401k and cannot do a individual Roth?

View attachment 339498

Staff online

-

d.kaufmanStill Here

Members online

- Dog1

- sp3worker

- Dholcomb

- mrm

- sharkey

- SharkyZiff

- starbreather

- traderjoe

- Vimace

- Longshot308

- EODFXSTI

- Yowally

- Quiet Observer

- snorko

- Packing Wood

- d.kaufman

- printcraft

- Mister K

- Doug

- schmart

- DestructionDan

- BeDome

- NyleRN

- Gravyman

- BAgun

- OneBadV8

- Bobby

- dmazzio

- El Conquistador

- Tradesylver

- XDdreams

- bobzilla

- gemihur

- CB1911

- Emerson Dambiggins

- Sagamore - One

- KLB

- jy951

- JTuttle

- BoilerWes

- 812 rimfire

- Pepi

- JStang314

- pharmboy

- jbm1521

- MC1983

- lafrad

- lance

- glocktoys

- slims2002

Total: 1,731 (members: 243, guests: 1,488)