I have similar situation with a spouse with major medical expenses (she has to have her battery replaced every so many years, not to mention the broken lead wires she has experienced multiple times, etc along with other concerns). She is older than I but I have always carried the benefits, and made the lion's share of the $. I've always prioritized benefits, etc as she has had the device and heart issues since her very early 30's. I'm not looking forward to medicare coverage, or something else before that.Biggest unknown is my wife has major medical expenses due to a auto immune disease that I can't predict very well. Fine while I have HSA. She maxes out her deductible by March on medications alone.

I wanted to go at 59 1/2 but will not be able to because of that. At first I was like I would have to work until I am 69 just to get her to medicare, but a friend of mine said put her on Obamacare. If that is viable, I will. So I may change and plan to 65 but hope for 62 if that works out.

-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retirement Thoughts

- Thread starter firecadet613

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

the first year it is expensive. Once your income level drops, the prices drop. And yes, medical coverage is the largest single worry we have.That's the main downside for me. I will retire pretty soon (long before 65) and Obamacare exchange insurance is the only reason I haven't already. Very few options, very expensive and only mediocre insurance coverage.

Regarding taxes in retirement, please keep in mind that for a couple (married, filing jointly), ordinary dividends are taxed at 0% up til your AGI hits a certain bigly threshold ($80-85k or so, I believe). And that's after your standard deductions, which can wipe out a big chunk of your interest income. If your income isn't too high, it's possible to pay zero Fed taxes. State and county will still get ya, but that's < 7%.

And as bobzilla mentioned, Obamacare gets really affordable once your income drops in retirement, as long as you don't need Cadillac coverage and you're ok with a fairly salty deductible.

And as bobzilla mentioned, Obamacare gets really affordable once your income drops in retirement, as long as you don't need Cadillac coverage and you're ok with a fairly salty deductible.

Yep.Listen to Dave Ramsey.

Pay off all debt.

Never get it again.

Match beats Roth beats traditional.

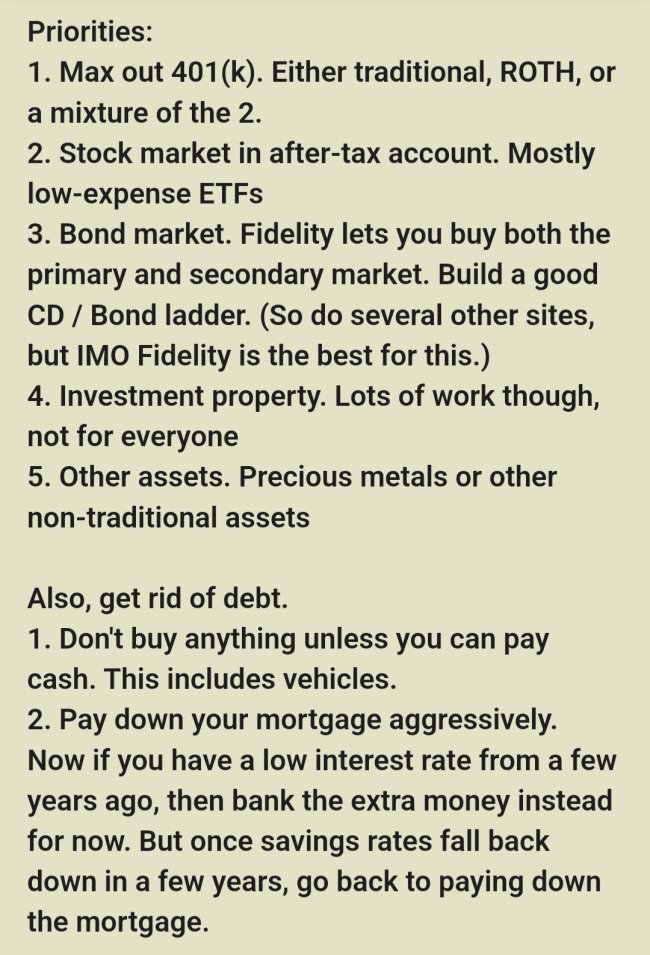

My purpose behind this thread is what do you do after all that...

A lot of great replies so far and I have plenty of digging to still do. After maxing out on the company 401k match and funding it to the max IRS allows, what are the next steps?

Last edited:

You're going to want some pre-taxed income. A roth for you and the spouse, max out as much as you can. IIRC $10k per year is hte max allowed by the IRS. It helps you when it comes time to take out money in retirement that not all of it has to be taxed. Put away some fluid savings to cover larger expenses you know you'll have in the next X-years. This keeps you from borrowing money to pay for cars/house repairs etc.Yep.

My purpose behind this thread is what do you do after all that...

A lot of great replies so far and I have plenty of digging to still do. After maxing out on the company 401k match and funding it to the max IRS allows, what are the next steps?

Once you've done all that, if you're STILL looking for a place to stash money, that's when you probably should see a broker and maybe start playing in the big boy fields with stocks.

I'm lucky, I have a pension. Yes, they did exist! The best investment we made was buying our first house, as soon as we could afford it. Other than that, diversify (including precious metals) and save, save, save. Try to get some good advice. Financial Peace University is a great low cost investment.

I've read through this entire thread and maybe I missed it but the #1 thing to having a good retirement is not getting a divorce!

Also I'm not a Dave Ramsey fan. Sure he has solid advice but I can't see that lifestyle being much fun. I've pissed away money on fast cars and motorcycle and loved every minute of it.

My last words on my deathbed will not be, "I wish I had listened to Dave Ramsey".

Also I'm not a Dave Ramsey fan. Sure he has solid advice but I can't see that lifestyle being much fun. I've pissed away money on fast cars and motorcycle and loved every minute of it.

My last words on my deathbed will not be, "I wish I had listened to Dave Ramsey".

Last edited:

Dave Ramsey?I've read through this entire thread and maybe I missed it but the #1 thing to having a good retirement is not getting a divorce!

Also I'm not a Dave Ramsey fan. Sure he has solid advice but I can't see that lifestyle being much fun. I've pissed away money on fast cars and motorcycle and loved every minute of it.

My last words on my deathbed will not be, "I wish i had listened to Dave Ramsey".

I got envelopes from living with my depression Era grandparents.

You do not have my permission to quote my posts. Once I post something stupid I don't want it repeated.Dave Ramsey?

I got envelopes from living with my depression Era grandparents.

You're going to want some pre-taxed income. A roth for you and the spouse, max out as much as you can. IIRC $10k per year is hte max allowed by the IRS. It helps you when it comes time to take out money in retirement that not all of it has to be taxed. Put away some fluid savings to cover larger expenses you know you'll have in the next X-years. This keeps you from borrowing money to pay for cars/house repairs etc.

Once you've done all that, if you're STILL looking for a place to stash money, that's when you probably should see a broker and maybe start playing in the big boy fields with stocks.

It sounds like that's where we're at since we're maxing out contributions to our employer matched 401k's and don't qualify for an additional individual Roth.

I'll likely call your guy sooner rather than later since it appears I hit a roadblock.

Oops I did it again!You do not have my permission to quote my posts. Once I post something stupid I don't want it repeated.

If IRA and 401k are maxed, you probably have already got 6 mo or a year of living expenses saved. I have 6 months. Each month I buy a 6 month CD for one month of expenses with it and keep it rolling. Gets a little more interest than average bank savings. So that every month one cd matures.It sounds like that's where we're at since we're maxing out contributions to our employer matched 401k's and don't qualify for an additional individual Roth.

I'll likely call your guy sooner rather than later since it appears I hit a roadblock.

Also, buy index funds in a brokerage fund. Don't need advice for those.

At your level getting a guy would be great to do.

Aren't you in Daytona?

You must have been right in the NASCAR thread. Nothing worth seeing there.

Especially if you are interacting with little ole me.

That CD trick you do is a good one.If IRA and 401k are maxed, you probably have already got 6 mo or a year of living expenses saved. I have 6 months. Each month I buy a 6 month CD for one month of expenses with it and keep it rolling. Gets a little more interest than average bank savings. So that every month one cd matures.

Also, buy index funds.

At your level getting a guy would be great to do.

I re-read the thread and @xwing seems to have laid out the next steps, I just needed to revisit it.

Daytona for 2 wheel racing.Aren't you in Daytona?

You must have been right in the NASCAR thread. Nothing worth seeing there.

Especially if you are interacting with little ole me.

At least NASCAR is popular enough to have an INGO thread.Daytona for 2 wheel racing.

Staff online

-

Cameramonkeywww.thechosen.tv

Members online

- r3126

- indyartisan

- drgnrobo

- Leadeye

- Destro

- Chewie

- Michigan Slim

- El Conquistador

- sharkey

- OneBadV8

- dwain

- dchuck

- Cameramonkey

- jcj54

- WebSnyper

- acd1010

- alc1985

- Steel and wood

- mike4sigs

- Averygc

- Timjoebillybob

- acss502

- tomcat13

- Grump01

- melensdad

- turnerdye1

- Dirtebiker

- Mgderf

- TJ Kackowski

- BigMoose

- draftyranger

- dustinfz6r

- snorko

- BlackGun

- Longhair

- slims2002

- x34822

- Hoosierdood

- JHB

- Onebad06vtx

- Living

- dieselrealtor

- Bybo

- browndog2

- jamil

- Topher Durden

- SSE

- Hillbilly

- 76caprice

- logguy

Total: 1,674 (members: 220, guests: 1,454)