I could never carry that much cash.If I don't have a grand I feel naked

-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Second Largest Bank Failure in U.S. History…

- Thread starter Ingomike

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

If I don't have a grand I feel naked

Probably a lot. I suspect a movie scene?I wonder how much setup had to go into getting that camera angle just right.

6 months after the bank fails. FDIC..."maybe we should look at why it failed? Other FDIC guy"You sure,because I am fairly certain everyone is doing what they did?"..."We waited 6 months I am sure it will be fine"

www.cnbc.com

www.cnbc.com

FDIC is probing former First Republic Bank directors and officers, spokesperson says

The investigation is the third the FDIC has opened into bank failures earlier this year which cost the government's deposit insurance fund about $32 billion.

Today.

www.zerohedge.com

www.zerohedge.com

Bank Bailout Fund Hits New Record High As Stocks Recouple With Fed Reserves | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Moody's US Downgrade Shows Why Treasury Yields Are Sticky | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The long weekend might be here

UBS has failed

34 Trillion deleted

UBS has failed

34 Trillion deleted

Last edited:

UBS…???The long weekend might be here

UBS has failed

34 Trillion deleted

Please let me know when physical gold n silver, guns n ammo get deleted from my hidey place.

Small Bank Deposit Outflows Continue As Fed Bailout Fund Usage Jumps To Another New Record High | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Buckle up boys and girls...Small Bank Deposit Outflows Continue As Fed Bailout Fund Usage Jumps To Another New Record High | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Sorry I'm late to this party. Did you even read that tweet or the article? The CEO of UBS was just speaking hypothetically about his preferred outcome in the unlikely scenario that UBS did fail.

And I have no idea what that other tweet is rambling on about. At least he used 300 alarm emojis to avoid looking like a crazy lunatic.

I couldn't find any corroborating stories that UBS was failing or that the Treasury was "deleting" the entire national debt. Might be time to stop getting your financial news from Twitter.

Last edited:

Moody’s Investors Service cut its rating outlook to negative from stable on Bank of America Corp., JPMorgan Chase & Co. and Wells Fargo & Co., but the stocks rallied Tuesday on the heels of tame inflation data.

dcclothesline.com

dcclothesline.com

More Problems With The Banks: JPMorgan Chase, Bank Of America And Wells Fargo Have All Had Their Ratings Downgraded - DC Clothesline

There is a reason why I am watching the banks so carefully. The banks are the beating heart of our economic system, and so if they get into big trouble we will all feel the pain. That is precisely what happened in 2008, and that is precisely what is happening again right now. In recent …

dcclothesline.com

dcclothesline.com

That headline is deceptively/purposefully misleading. If 64 US banks went out of business in a week, that would be frightening. When a half dozen mega-banks make business decisions to close 64 of their BRANCHES, that's not even news. They've been doing that since online banking became a thing.

According to Wikipedia, PNC still has 2600 branches and Chase still has 5100. Closing 20 each isn't even a drop in the bucket when you consider no one physically goes to a bank branch anymore.

It also leaves out how many new branches they've opened this year.That headline is deceptively/purposefully misleading. If 64 US banks went out of business in a week, that would be frightening. When a half dozen mega-banks make business decisions to close 64 of their BRANCHES, that's not even news. They've been doing that since online banking became a thing.

According to Wikipedia, PNC still has 2600 branches and Chase still has 5100. Closing 20 each isn't even a drop in the bucket when you consider no one physically goes to a bank branch anymore.

With developing companies, they always close some locations while still building 300+ new ones a year...

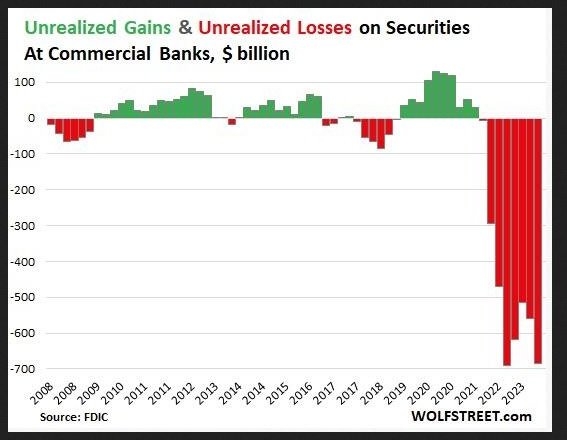

Unrealized Losses At US Banks Exploded In Q3 | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Regulators Hope You Don't Notice The Massive Hidden Losses In The Banking System | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

If unrealized interest rate losses were realized, they would consume more than half of the banking system’s $2.3 trillion in total equity capital.

As of June 30, 2023, only 8 banks had a regulatory Tier 1 leverage ratio below the 6 percent threshold that regulators use to designate a bank as “well capitalized”. No bank has a ratio below the 4 percent threshold that designates an “undercapitalized” institution. By this regulatory measure, the banking system appears to be well-capitalized, but this regulatory ratio ignores the actual market value of bank assets.

Adjusting bank Tier 1 regulatory capital ratios by the unrealized mark-to-market losses on bank securities reported by banks, and by a reasonable (likely low) estimate of the mark-value losses banks have suffered on their loan and lease portfolios, gives a radically different picture of the banking system’s capital adequacy. Out of the 4697 insured depository institutions, 2372 have market-value adjusted Tier 1 leverage ratios smaller than the 4 percent “undercapitalized” threshold requiring regulators to take “prompt corrective action”. This number includes 1790 banks with ratios below the 3 percent “significantly undercapitalized” threshold. Undercapitalized banks hold more than 54 percent of the total assets in the banking system including more than 46 percent held in significantly undercapitalized institutions.

The Treasury Secretary and FSOC members are well aware of the danger posed by unrealized interest rate related losses in the banking system, but you would not know it from their public statements. Regulators should be using prompt corrective action powers to restrict under-capitalized banks from paying dividends and require them to raise new capital. Instead they have allowed banks to pay out almost $96 billion in dividends in the first half of 2023 and focused their regulatory efforts on imposing new complex capital regulations for the largest banks that would not address this real systemic problem.

Federal bank regulators are hoping that if they ignore this problem, you will too, and the problem will go away when the inflation genie is back in the bottle and interest rates decline. But this may not happen soon. Core inflation is still running at nearly twice the Fed’s target rate, unemployment is low, economic growth remains stronger than many anticipated, and Congress remains on a massive deficit spending spree. Hoping for a speedy return to a near zero environment before there a run of costly bank failures is not a sound regulatory strategy.

Staff online

-

mom45Momerator

-

GodFearinGunTotinSuper Moderator

-

d.kaufmanStill Here

Members online

- Glocktard

- Born2vette

- bsmithg19

- Triton

- ranger391xt

- Butch627

- mac45

- bub74

- Meatstick

- Judamonster

- Plumbous

- Pop2you

- BigBoxaJunk

- turnandshoot4

- Colt556

- Piezak

- Lmo1131

- MrSmitty

- Georgemartinn

- Midwestjimbo

- mom45

- barber613

- Chalky

- bcoe5371

- jake 2000

- Wolffman

- adam

- GodFearinGunTotin

- jy951

- Brando

- JAL

- Got SIG?

- knutty

- user11230706

- Mr24g

- Avi8tor

- courier6

- Charlie3p0

- d.kaufman

- Big rob

- Scott58

- rdbs505

- Luke.Schlatter

- darkon256

- vzdude

- KoopaKGB

- ROOTS54454

- pokersamurai

- ditcherman

- sescbo

Total: 1,832 (members: 67, guests: 1,765)