-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock market.... What are you doing?

- Thread starter zippy23

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

- Status

- Not open for further replies.

hoosierdoc

Freed prisoner

Futures all over the place last night. Down 300 now

I applied for margin and option privileges. Margin was an instant approval, gotta wait a day for options. We'll see.

I applied for margin and option privileges. Margin was an instant approval, gotta wait a day for options. We'll see.

Last edited:

Bank Of Japan Buys Record 101 Billion Yen In ETFs To Stabilize Markets

https://www.zerohedge.com/health/bank-japan-buys-record-101-billion-yen-etfs-stabilize-markets

It is like giving a junkie a fix.It will not last long,nothing has changed.Not the supply problems.Not production.Not the number of people locked in their homes.

It certainly is not slowing the covid-19.

The warning came as part of Thursday's Joint Chief of Staff daily intelligence brief and, according to a document obtained by Newsweek, officials expect COVID-19 will "likely" become a global pandemic within the next 30 days.

Officials have expected global cases would spread. On Tuesday, the National Center for Medical Intelligence (NCMI) raised the Risk of Pandemic warning. It went from WATCHCON 2, a probable crisis, to WATCHCON 1, an imminent crisis, due to sustained human-to-human transmission outside of China, according to a report summary obtained by Newsweek.

https://www.newsweek.com/coronavirus-department-defense-pandemic-30-days-1489876

Another trading app down this morning.

@Robinhood is a joke. One of the biggest trading Mondays in recent history and the app is completely down and crashed since opening bell. People are losing THOUSANDS over this nonsense.

https://www.zerohedge.com/health/bank-japan-buys-record-101-billion-yen-etfs-stabilize-markets

It is like giving a junkie a fix.It will not last long,nothing has changed.Not the supply problems.Not production.Not the number of people locked in their homes.

It certainly is not slowing the covid-19.

The warning came as part of Thursday's Joint Chief of Staff daily intelligence brief and, according to a document obtained by Newsweek, officials expect COVID-19 will "likely" become a global pandemic within the next 30 days.

Officials have expected global cases would spread. On Tuesday, the National Center for Medical Intelligence (NCMI) raised the Risk of Pandemic warning. It went from WATCHCON 2, a probable crisis, to WATCHCON 1, an imminent crisis, due to sustained human-to-human transmission outside of China, according to a report summary obtained by Newsweek.

https://www.newsweek.com/coronavirus-department-defense-pandemic-30-days-1489876

Another trading app down this morning.

@Robinhood is a joke. One of the biggest trading Mondays in recent history and the app is completely down and crashed since opening bell. People are losing THOUSANDS over this nonsense.

Futures all over the place last night. Down 300 now

I applied for margin and option privileges. Margin was an instant approval, gotta wait a day for options. We'll see.

Options are amazing. I got some cheap ways of playing them. I have been getting my friends into trading them, they can't believe what they make on them. I got one stock called NRZ, owned it for years and it pays 10-15% a year dividend($2 per share). Last year I parlayed that 10-15% dividend into over 4000% returns.....and did it safely without much risk. Another one is AGNC. I am leary of this rally today on low volume...may be a sucker rally. We should know if SPY gets rejected at 304, if it breaks that we may run more.

hoosierdoc

Freed prisoner

are you doing straddles on your shares or something? I remember you as an options guy. I am a novice though. NRZ has nice dividend but look at their cash for over last few years. Went from $1B positive to $2 negative. Is that sustainable?

My SPXL and DUSL are doing great. up 16% and 12% repsectively since 2pm friday

My SPXL and DUSL are doing great. up 16% and 12% repsectively since 2pm friday

are you doing straddles on your shares or something? I remember you as an options guy. I am a novice though. NRZ has nice dividend but look at their cash for over last few years. Went from $1B positive to $2 negative. Is that sustainable?

My SPXL and DUSL are doing great. up 16% and 12% repsectively since 2pm friday

I don't do straddles. I own/trade shares and just buy puts and /or calls when I know it is right. February 10th or so I sold my shares and calls after earnings release. I then went into puts...sold them last week and bought back my shares and calls. They will announce a dividend soon and it may increase, that is why I bought shares back so I will own them when divy is paid, plus stock will move up into dividend date. I will continue to hold shares thru the ER in May and at that point hope to cash out shares and calls, and buy back puts. Collect divy and use it to get ready for the next go around. If I can learn options, a smart fella like you will have no problem. Use www.optionsprofitcalculator.com to run trades before you do them. You can also use TDA think or swim and use paper money to practice.

On another note, SPY got rejected right on 304 like I thought it would...now it will make another run at it, hope it don't get rejected again.

hoosierdoc

Freed prisoner

still trying to understand all of that. Are you saying you buy long before the dividend and then sell puts based on expectation it'll drop once dividend is paid? is dividend annual or quarterly? I don't see how that scales up so far.

I almost sold my DUSL and SPXL this afternoon. Then it dropped and i kicked myself. Then they closed at day highs. I'm up 14 and 20% respectively since friday afternoon. Not sure how long to hold those leveraged things. Seems market should keep going up for a few days unless awful news hits. considering buying a bear fund of financials before results are in for super tuesday. Bernie win was a big hit for financials last time

I almost sold my DUSL and SPXL this afternoon. Then it dropped and i kicked myself. Then they closed at day highs. I'm up 14 and 20% respectively since friday afternoon. Not sure how long to hold those leveraged things. Seems market should keep going up for a few days unless awful news hits. considering buying a bear fund of financials before results are in for super tuesday. Bernie win was a big hit for financials last time

still trying to understand all of that. Are you saying you buy long before the dividend and then sell puts based on expectation it'll drop once dividend is paid? is dividend annual or quarterly? I don't see how that scales up so far.

I almost sold my DUSL and SPXL this afternoon. Then it dropped and i kicked myself. Then they closed at day highs. I'm up 14 and 20% respectively since friday afternoon. Not sure how long to hold those leveraged things. Seems market should keep going up for a few days unless awful news hits. considering buying a bear fund of financials before results are in for super tuesday. Bernie win was a big hit for financials last time

Yeah, I will explain the options better later. I try to always stay ahead of the trend on it. Surprisingly, NRZ dont usually get hit that bad with dividend payment, it usually recovers to pre divy price within a week or 2....because people will want to own it for the earnings release a month later. On ER day is when I usually start selling calls and try to get back in puts. I never drip dividends on this. It is quarterly, .50 per quarter.

The market had a "V" pattern confirmed today. Don't see them often but if it is correct....SPY will go back near highs in short term.

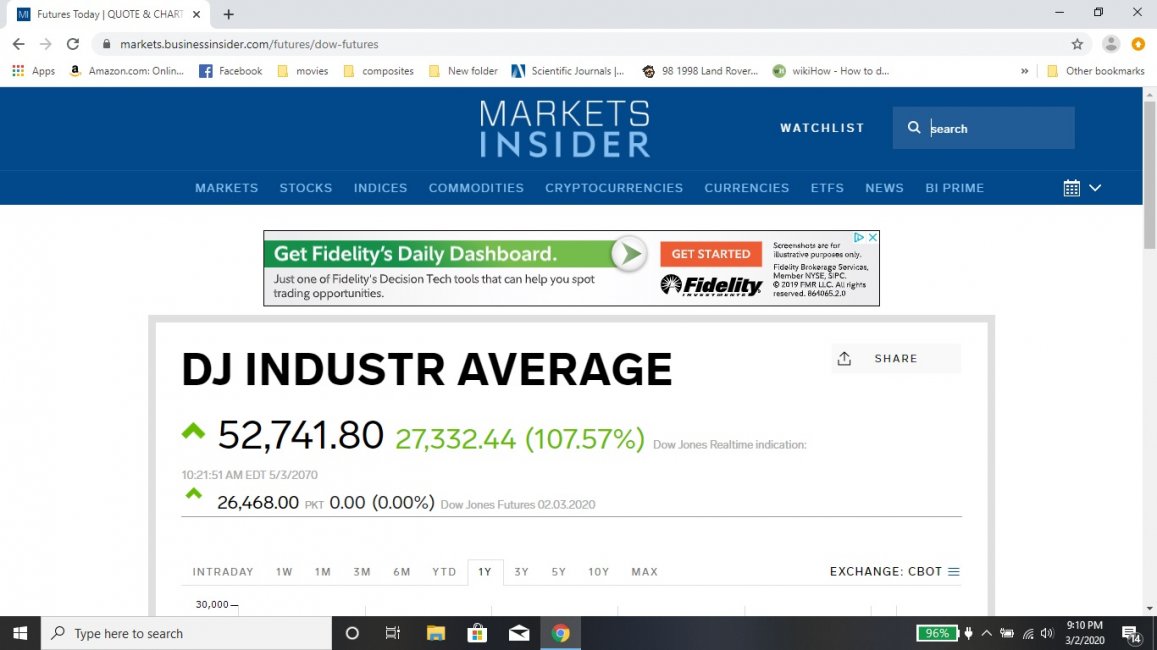

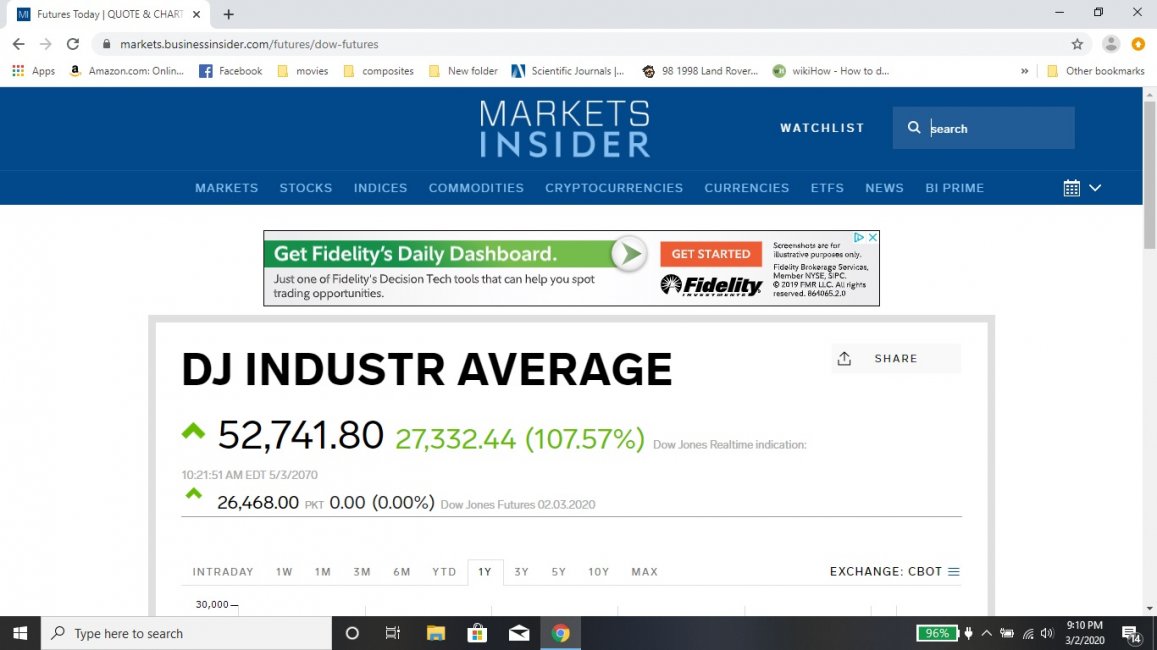

Oh,they broke something ROFL. DOW futures +107.57%

https://markets.businessinsider.com/futures/dow-futures

Must have forgot to shut off that algo pumping the market up.

The DOW going up over double the value at close...yea this is normal ROFL.

.....crickets.

https://markets.businessinsider.com/futures/dow-futures

Must have forgot to shut off that algo pumping the market up.

The DOW going up over double the value at close...yea this is normal ROFL.

.....crickets.

Last edited:

Oh,they broke something ROFL. DOW futures +107.57%

https://markets.businessinsider.com/futures/dow-futures

View attachment 84600

Must have forgot to shut off that algo pumping the market up.

The DOW going up over double the value at close...yea this is normal ROFL.

.....crickets.

Trump is awesome!

Yeah, yesterday was a mess. Leap year messed up some companies. Robinhood got shut down all day, programmers forgot to code in leap year or something like that (over my head).

I am trying to buy March 4 expiration 320 SPY calls....hope to get them around .15-.20 each if market dips a little. If market goes to 320 by tomorrow at close, every 100 contracts would cost $1500 and pay around $15,000 back. If you were to pay .30 each, $3000 would become $15,000, etc. See how this plays out. The downside if it falls back to 290's, you lose everything, or most of it and quickly. These expire tomorrow, so you either win or lose quick. You could buy fewer contracts, like 10 contracts would only cost you $150 at .15 or $300 at .30, or you can buy 1 contract for $15 and $30. Just remember, 1 contract is 100 options.

IT IS RISKY SO DON'T FOLLOW ME. I don't want to feel responsible for anyone losing money. I am not a professional and don't give advice. Just sharing my trades with you guys for educational purposes. I am banking on V pattern playing out.

I am trying to buy March 4 expiration 320 SPY calls....hope to get them around .15-.20 each if market dips a little. If market goes to 320 by tomorrow at close, every 100 contracts would cost $1500 and pay around $15,000 back. If you were to pay .30 each, $3000 would become $15,000, etc. See how this plays out. The downside if it falls back to 290's, you lose everything, or most of it and quickly. These expire tomorrow, so you either win or lose quick. You could buy fewer contracts, like 10 contracts would only cost you $150 at .15 or $300 at .30, or you can buy 1 contract for $15 and $30. Just remember, 1 contract is 100 options.

IT IS RISKY SO DON'T FOLLOW ME. I don't want to feel responsible for anyone losing money. I am not a professional and don't give advice. Just sharing my trades with you guys for educational purposes. I am banking on V pattern playing out.

And that's how you do it. Waited patiently for .20 calls, market just spiked on rate cut and they spiked to 1.92, sell and walk away! Every $1000 invested became almost $10,000 in 30 minutes. Now if I could just ever get the confidence to put more into these trades. It is no wonder hedge funds have bazillionaires.

Golly! I'm sure glad I was able to sell while the market was on it's way down. Since it seems to be going back up, I'll watch it until I'm sure it is recovering and then buy back in.

Nah. Really, I just rode it out like I did in the other crashes.

Nah. Really, I just rode it out like I did in the other crashes.

And that's how you do it. Waited patiently for .20 calls, market just spiked on rate cut and they spiked to 1.92, sell and walk away! Every $1000 invested became almost $10,000 in 30 minutes. Now if I could just ever get the confidence to put more into these trades. It is no wonder hedge funds have bazillionaires.

Last week I finally got around to opening a TDAmeritrade account to play around with stocks a little and right now have only bought and held.

I enjoy reading your posts, but have no idea what this options stuff means. Watched some videos and just can't wrap my head around it. The numbers don't make sense to me. There are so many different types of options trades in the app it's confusing.

Golly! I'm sure glad I was able to sell while the market was on it's way down. Since it seems to be going back up, I'll watch it until I'm sure it is recovering and then buy back in.

Nah. Really, I just rode it out like I did in the other crashes.

Ditto. Retirement is a long ways away for me...

Good point. Take it in cash and stuff it in your dresser drawers.

Apply purple if you think necessary.

What's the current interest rate in sock lint?

One good thing right now, mortgage rates are looooow. Not low enough for me to refinance (about six years out from full repayment), but maybe for others.

- Status

- Not open for further replies.